The 2023 J.D. Power Brand Loyalty Study sheds light on shifting consumer behavior in the US automotive industry as it recovers from pandemic-related disruptions. Supply chain issues led to a decline in brand loyalty, but some automakers maintained strong customer bases.

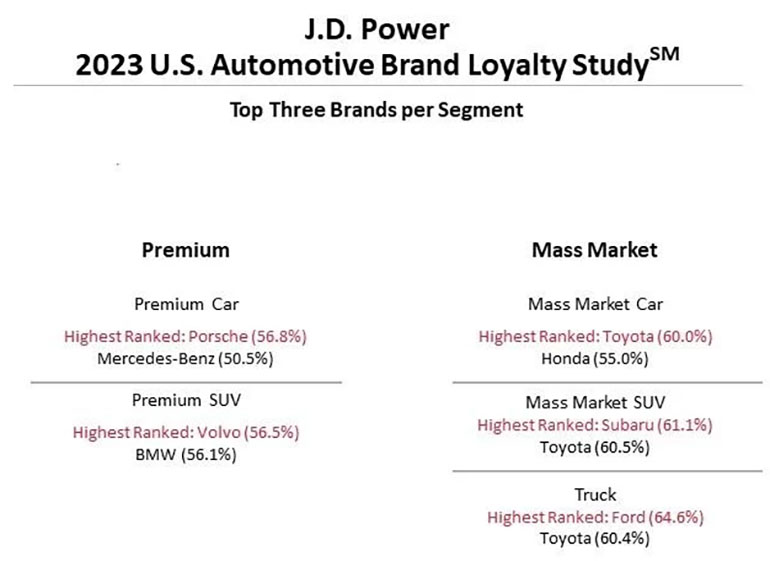

In the premium segment, Porsche secured the top spot with a 56.8% loyalty rate, followed by Mercedes-Benz at 50.5%. In the premium SUV category, Volvo led with 56.5%, followed by BMW at 56.1%. Among mass-market brands, Toyota topped the list with a 60% loyalty rate, followed by Honda at 55%. Subaru retained the mainstream SUV crown with 61.1% loyalty. Ford led the truck segment for the second year with a 64.6% loyalty rate.

The study attributes the loyalty shift to increased vehicle availability, longer ownership due to supply chain issues, and more customer choices in the market. The study evaluates brand loyalty across five segments: premium car, premium SUV, mass-market car, mass-market SUV, and trucks, using data from the Power Information Network.

Source: J.D. Power

Mike Floyd is a finance executive by trade and a car enthusiast at heart. As a CFO with a keen eye for detail and strategy, Mike brings his analytical mindset to the automotive world, uncovering fresh insights and unique perspectives that go beyond the surface. His passion for cars—especially his favorite, the Porsche 911, fuels his contributions to Automotive Addicts, where he blends a love for performance and design with his professional precision. Whether he’s breaking down industry trends or spotlighting emerging innovations, Mike helps keep the site both sharp and forward-thinking.