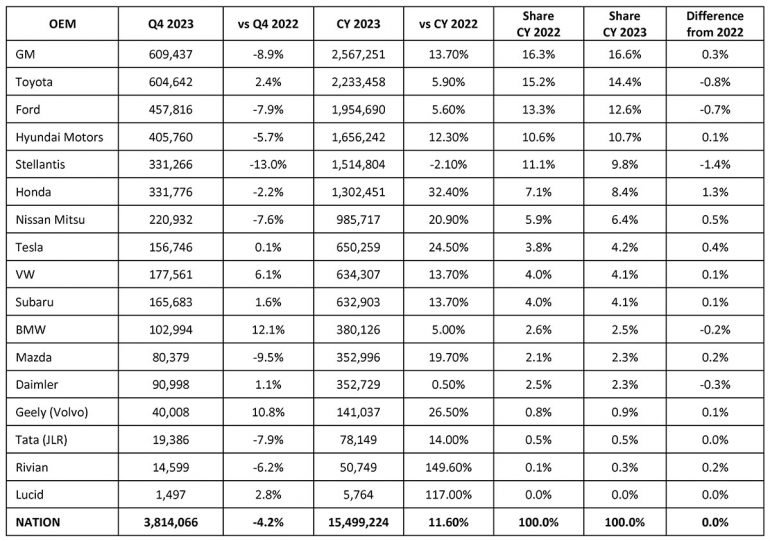

During 2023, the U.S. auto industry experienced a rebound, marking its best sales year since the onset of the pandemic. General Motors (GM) successfully surpassed its competitor, Toyota, securing its position as the top-selling automaker in the country. Despite challenges such as a costly auto strike, GM reported impressive U.S. new vehicle sales of approximately 2.6 million units, reflecting a robust 14.1% increase from the previous year. Toyota, while posting a commendable annual sales growth of 6.6%, trailed behind with about 2.25 million vehicles sold.

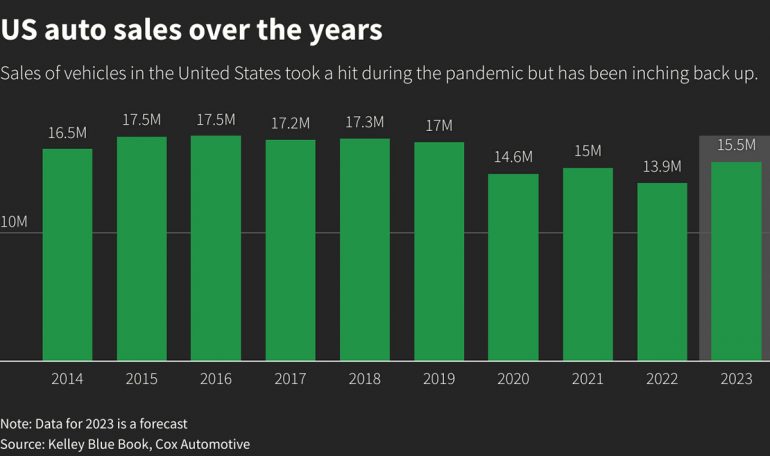

The overall industry performed exceptionally well, with total U.S. vehicle sales reaching an estimated 15.5 million units in 2023, surpassing the figures of 2019 and 2022. This resurgence in sales can be attributed to automakers ramping up production to meet sustained demand for new vehicles throughout the year. However, some industry analysts caution that the impact of high interest rates may pose a challenge to demand in the coming year.

Despite the industry’s success, concerns lingered about the influence of elevated vehicle prices and interest rates on consumer purchasing behavior. Analysts from Cox Automotive referred to these factors as the “industry’s Grinch,” suggesting that the trend may persist into the next year. In response to a perceived easing of demand, car dealers resorted to offering generous incentives and discounts in December to clear older inventory, following two years of restrained promotions.

A notable trend in 2023 was the increasing popularity of electric vehicles (EVs). Toyota reported a substantial 30.4% growth in sales of electrified vehicles, constituting 29.2% of its overall U.S. sales. Meanwhile, GM sold 75,883 EVs, with a significant portion being Bolts and Ultium platform EVs. Despite the positive momentum, industry experts anticipate that high interest rates may impede the meteoric rise of EV sales witnessed in previous years.

Source: Cox Automotive

Toyota’s commitment to electrification is evident in its annual sales figures, where hybrid vehicles and all-electric models collectively accounted for a considerable share. GM, optimistic about future demand, predicts a carryover of robust demand into 2024, forecasting total industry sales of 16 million units for the year. However, the company faced stock market challenges, with its shares initially declining before partially recovering following the announcement of full-year sales.

In response to the evolving market dynamics, GM revealed plans to offer $7,500 incentives on its EVs, compensating for the loss of a U.S. government tax credit. Other automakers, including Hyundai, Mazda, and Honda, also reported higher annual sales, contributing to the industry’s overall positive performance. Despite the positive outlook for EVs, analysts expect a moderation in the growth rate, emphasizing the potential impact of high interest rates on consumer preferences.

The U.S. auto industry’s resilience in 2023, marked by impressive sales figures and a growing interest in electric vehicles, provides a glimpse into the sector’s adaptability. As the industry navigates challenges such as interest rates and evolving consumer preferences, stakeholders remain cautiously optimistic about sustaining momentum in the years to come.

Sources: Cox Automotive, Reuters

Mike Floyd is a finance executive by trade and a car enthusiast at heart. As a CFO with a keen eye for detail and strategy, Mike brings his analytical mindset to the automotive world, uncovering fresh insights and unique perspectives that go beyond the surface. His passion for cars—especially his favorite, the Porsche 911, fuels his contributions to Automotive Addicts, where he blends a love for performance and design with his professional precision. Whether he’s breaking down industry trends or spotlighting emerging innovations, Mike helps keep the site both sharp and forward-thinking.