Automakers around the world have expressed plans to repurpose electric vehicle (EV) batteries once they lose their power. However, the competition for battery packs and cell materials, as well as the demand for affordable cars, raises doubts about the feasibility of this aspect of the circular economy.

Several startups have emerged, offering second-life energy storage using old EV batteries. Nonetheless, establishing a viable industry, as envisioned by carmakers like Nissan, would entail overcoming competition from recyclers, refurbishers, and the needs of cost-burdened drivers affected by the cost-of-living crisis. Hans Eric Melin, the founder of consultancy Circular Energy Storage (CES), which monitors battery volumes and prices, disputes the assumption that EV batteries will last only eight to ten years before being replaced. He believes that making second-life applications work will be challenging.

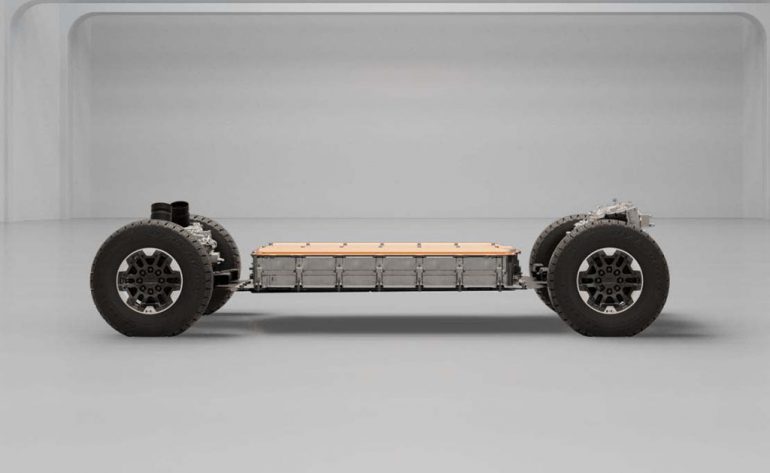

While second-life energy storage may be a potential solution for buses, trucks, and other commercial vehicles, it will likely take longer for batteries from passenger cars to be reused on a large scale. The concept behind second-life energy storage is relatively simple. According to the theory, when the capacity of EV batteries falls below 80%-85% after eight to ten years of use, they can be repurposed to power buildings or help balance local and national energy grids.

Investors who believe in the circular economy, where products and materials are repaired and reused, have already provided approximately $1 billion in funding to nearly 50 startups globally. Additionally, car manufacturers such as Mercedes and Nissan have established their own second-life operations. However, the main challenge lies in the scarcity of old EV batteries, which shows no signs of easing. The increasing average age of fossil-fuel cars on the road, reaching a record 12.5 years in the United States, indicates that many EVs will continue to be used for years, even if their batteries become depleted.

The 80% threshold, often mentioned as the point at which batteries are considered for second-life applications, is viewed by some experts as an arbitrary number that does not reflect the real-world usage of EVs. Elmar Zimmerling, the business development manager for automotive at German second-life battery startup Fenecon, states that there is currently almost no market for second-life batteries due to the ongoing use of EVs built a decade ago. However, he predicts a surge in batteries within the next five years.

Competition from entities utilizing EV batteries for various purposes, including powering classic cars or boats, has driven up prices. According to CES, prices reached $235 per kilowatt-hour in late 2022, roughly double the price paid by major carmakers for new batteries. For example, a long-range Tesla Model 3 with a 75 kWh battery pack would cost around $17,625 on the used market at that rate.

Car and battery manufacturers increasingly offer energy storage systems using new batteries, further intensifying competition for second-life applications. Recycling batteries, although more energy- and carbon-intensive, also poses a competitive alternative due to the value of raw materials present in batteries. BMW, which operates a second-life battery storage facility at its Leipzig plant, acknowledges that recycling might be a better option to extract the most value from batteries.

The demand for used batteries for energy storage is expected to surge as intermittent renewable energy plays a larger role. The International Energy Agency estimates that by 2030, global battery capacity for grid storage could increase to 680 gigawatt-hours, up from 16 GWh at the end of 2021. In countries like Britain, the lack of battery storage capabilities forces them to pay significant sums to switch off wind farms when the grid does not require the power.

U.S. startup Smartville has found a solution by purchasing packs from EVs declared total losses by insurers. Since insurers cannot accurately assess the extent and cost of damage to EV batteries, entire cars with almost 100% battery capacity are often scrapped. CEO Antoni Tong estimates that over 1 GWh of salvaged batteries will enter the U.S. market annually by 2026.

One significant challenge is the increasing number of people holding onto their vehicles for longer periods. For example, Jonathan Rivera, a resident of Coeur d’Alene, Idaho, purchased a used 2011 Nissan Leaf last September. After 12 years of use, the electric car’s range had decreased from 120 miles to 40 miles. However, Rivera, who used the car for an 18-mile commute to work, did not consider this an issue. He sold the car recently for $3,000 but intends to buy another used EV since the vehicle satisfied 90% of his driving needs and he believes it can last another five to six years.

Even when owners decide to part with their EVs, many of these vehicles simply disappear. In the UK, approximately 20% of EVs disappear and are often sold overseas. This poses a challenge in terms of retrieving batteries for second-life applications. Commercial vehicles, such as buses, currently provide the most promising opportunity for second-life batteries, according to industry officials. Startups like Zenobe, based in London, collaborate with bus companies seeking to transition to electric vehicles. While the bus companies purchase the buses, Zenobe acquires and manages the batteries for second-life energy storage.

Zenobe has raised approximately $1.2 billion in debt and equity funding since 2017. They currently own 435 megawatt-hours of batteries in approximately 1,000 electric buses across the UK, Australia, and New Zealand, with plans to expand to 3,000 buses by 2025. Steven Meersman, the Founder Director of Zenobe, predicts that when all of Britain’s 40,000 buses become electric, they will possess 16 gigawatt-hours of batteries on board, equivalent to approximately one-third of Britain’s peak demand in 2022. He describes this as a “gigafactory on wheels waiting to happen.”

Source: Reuters

Lloyd Tobias is a seasoned automotive journalist and passionate enthusiast with over 15 years of experience immersed in the world of cars. Whether it’s exploring the latest advancements in automotive technology or keeping a close pulse on breaking industry news, Lloyd brings a sharp perspective and a deep appreciation for all things automotive. His writing blends technical insight with real-world enthusiasm, making his contributions both informative and engaging for readers who share his love for the drive. When he’s not behind the keyboard or under the hood, Lloyd enjoys test driving the newest models and staying ahead of the curve in an ever-evolving automotive landscape.