Aston Martin has entered into a partnership with Lucid Group, an American electric vehicle (EV) manufacturer. In exchange for access to Lucid’s high-performance EV technology, Aston Martin will grant Lucid a 3.7% stake in the company. The agreement involves cash payments and the issuance of approximately $232 million worth of new ordinary shares. This collaboration is crucial for Aston Martin, as smaller carmakers like them heavily rely on partnerships to navigate the costly transition to electric vehicles. Aston Martin plans to release its first EV in 2025, previously relying on Mercedes-Benz for technological support.

In another announcement, Aston Martin stated that it has modified its agreement with Mercedes-Benz. While the German automaker will not increase its stake in Aston Martin as initially planned, it will maintain its approximately 9% ownership and continue to provide engine and EV technology support.

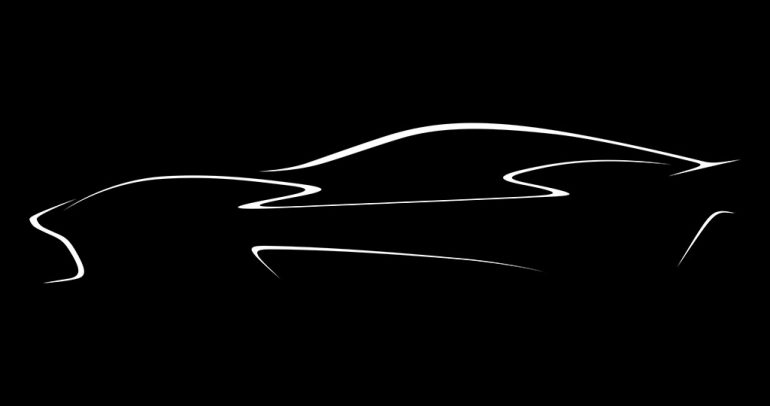

Aston Martin’s partnership with Lucid will grant them access to industry-leading technology for their battery electric vehicles (BEVs), including electric powertrains and battery systems. The company aims to have all new models electrified by 2026 and a fully electric core range by 2030, expressing confidence in their electrification strategy with the support of two world-class suppliers.

Aston Martin recently received investment from Geely, a Chinese carmaker, which will provide access to Geely’s technologies and components. Both Lucid and Aston Martin have a common shareholder in Saudi Arabia’s Public Investment Fund (PIF), with PIF becoming Aston Martin’s second-largest shareholder last year. PIF is also the main shareholder of Lucid and recently contributed a majority of the funds for a $3 billion stock offering by the U.S. EV maker. These additional funds are crucial for Lucid as it faces mounting losses, tightening cash reserves, recession fears, and a price war instigated by Tesla Inc. Lucid, known for its luxury Air sedans, adjusted its 2023 production forecast and reported lower-than-expected revenue in the first quarter. Aston Martin shares experienced a significant increase, rising approximately 10% during trading.

Mike Floyd is a finance executive by trade and a car enthusiast at heart. As a CFO with a keen eye for detail and strategy, Mike brings his analytical mindset to the automotive world, uncovering fresh insights and unique perspectives that go beyond the surface. His passion for cars—especially his favorite, the Porsche 911, fuels his contributions to Automotive Addicts, where he blends a love for performance and design with his professional precision. Whether he’s breaking down industry trends or spotlighting emerging innovations, Mike helps keep the site both sharp and forward-thinking.